by Pablo Salinas

Today, Secretariat marks the 135th anniversary of the Sherman Antitrust Act, enacted by the 51st U.S. Congress and signed into law by President Benjamin Harrison on July 2, 1890. The Act was the first comprehensive federal legislation to promote competition, criminalize monopolistic behavior, and empower courts to uphold economic efficiency as a public good.

The Sherman Act remains actively enforced and has never been repealed or amended. It established two key prohibitions that are central to antitrust enforcement:

- Section 1 bans any contract, combination, or conspiracy in restraint of trade

- Section 2 makes it a felony to monopolize, or attempt to monopolize, any market

With over a century of enforcement history and growing relevance in today’s digital and data-driven economy, the Sherman Act remains the cornerstone of American competition law.

From Railroads to Algorithms

“An unamended cornerstone of antitrust, the Sherman Act endures through its focus on economic efficiency, bridging eras of threatened competition despite falling prices and rising output.”

— Pablo Salinas, PhD, Economist

The Act passed with overwhelming bipartisan support: 242–0 in the House and 52–1 in the Senate. The near-unanimous decision took place against a backdrop of rising output and falling prices, much like today’s digital economy. Despite dramatic improvements in freight logistics and a ~40% decline in real rail rates between 1880 and 1900, lawmakers feared the long-term harm posed by monopolistic trusts like Standard Oil, which vertically integrated oil refining with rail transport. These trusts threatened to:

- Foreclose market access for rivals

- Discriminate in favor of their own products

- Inflate input costs

- Lock in suppliers through exclusive contracts

Today’s digital platforms exhibit similar traits. Giants like Google, Amazon, Meta, and Apple operate at massive scale, benefit from network effects, and provide low-cost (often free) services. Yet they increasingly face antitrust scrutiny—not because they raise prices, but because they control data, infrastructure, and market access in ways that may stifle competition.

Google may prioritize its own services in search. Apple imposes a 30% fee on in-app purchases. Meta has acquired potential rivals like Instagram and WhatsApp. Amazon observes both buyers and sellers on its platform, raising concerns about self-preferencing. These firms also control proprietary datasets that are inaccessible to competitors, creating what regulators describe as “data moats.” In the words of industry leaders and public officials, “data is the new oil.”

A Modern Enforcement Framework

The Sherman Act’s enforcement is now supplemented by:

- The Clayton Act of 1914, which added civil enforcement tools to address mergers, tying, price discrimination, and interlocking directorates before they harm competition

- The Federal Trade Commission Act of 1914, which established the FTC and outlawed unfair methods of competition

Unlike the Sherman Act, which includes criminal penalties, the Clayton Act is purely civil and allows regulators to preempt anticompetitive behavior, especially in mergers and vertical integration, without needing to prove actual harm.

Economic Theory and the Digital Era

Modern markets differ fundamentally from the industrial sectors of the 19th century. Digital products are often non-rival, marginal costs approach zero, and market dominance can persist even as prices fall. This challenges traditional antitrust paradigms that focus on price and output and shifts attention to data control, entry barriers, and platform entrenchment.

Economics of Antitrust at Secretariat

“Without rigorous economic insight, antitrust enforcement risks becoming reactive guesswork rather than a disciplined defense of competitive markets.”

— Jéssica Dutra, PhD, Director

Understanding Sherman Act enforcement today requires fluency in economic theory, technological structure, and platform design.

At Secretariat, we apply advanced economic analysis to help clients navigate Sherman Act enforcement across a range of high-value industries:

Health Care

We advise on the antitrust risks of hospital consolidation, exclusive contracts with suppliers, and pricing practices among insurers, healthcare group purchasing organizations, and pharmacy benefit managers. Recent scrutiny has focused on conduct under Section 1 involving collusion or exclusionary contracting that may restrict competition and raise costs.

“The Sherman Act safeguards competition as the cornerstone of a free market, a principle especially vital in healthcare, where anticompetitive conduct can raise prices and restrict patient access. In a sector where lives and livelihoods are at stake, the Sherman Act ensures that innovation and affordability aren’t casualties of consolidation.”

— Jason Albert, PhD, Director

Auctions

Bid rigging remains one of the clearest Sherman Act violations. We help clients detect, prevent, and litigate collusion in contexts including construction, spectrum auctions, advertising, foreclosure sales, and government procurement.

“The Sherman Act prohibits collusive practices that undermine competitive bidding in auctions, such as bid rigging or market allocation, which distort price discovery and harm allocative efficiency. Robust auction competition is essential to preserving the Act’s core goal of protecting the competitive process.”

— Panos Dimitrellos, PhD, Associate Director

“Historically, as much as 50 percent of the collusion cases brought by the US Department of Justice have involved alleged bid-rigging in auction markets. This illustrates the important role the Sherman Act plays in promoting competitive auction markets and the importance of diligently policing bidding practices in those markets.”

— Allan Ingraham, PhD, Managing Director

Labor Markets

The Sherman Act is increasingly invoked to address wage suppression, non-poach agreements, and monopsony power. From fast food franchises to tech giants, antitrust enforcers are challenging practices that restrain worker mobility and suppress wages.

“The potential for anticompetitive practices by employers in labor markets has led to a renewed interest in using the Sherman Act to ensure fair competition for workers and prevent the abuse of employer monopsony power through practices such as agreements to fix wages, no-poach and non-compete agreements, or mergers and acquisitions that reduce competition in labor markets.”

— Stuart Gurrea, PhD, Managing Director

At the CBV CONNECT 2025 Conference in Toronto, we had the privilege of presenting multiple panels, engaging with fellow business valuation professionals, and exploring the latest developments shaping the future of the industry.

We’ve compiled key takeaways from our time at CONNECT 2025 below, highlighting critical insights from our speaking engagements and the emerging trends we’re watching in the world of business valuation.

Understanding MAE clauses is a must when navigating high-stakes valuation and litigation scenarios in a post-COVID world.

Aayush Mittal and Michael Moxley spoke on a panel about “Material Adverse Effects and Damages in Failed Merger Disputes,” a topic that continues to challenge courts, counsel, and companies alike. The session explored how MAE clauses are interpreted in practice, the legal and strategic considerations when invoking them, and the complex interplay between walk rights and damage remedies when deals fall apart. Understanding MAE clauses and their application has become essential knowledge for M&A practitioners, particularly in the post-COVID landscape, where buyers have attempted to walk away from deals due to performance declines.

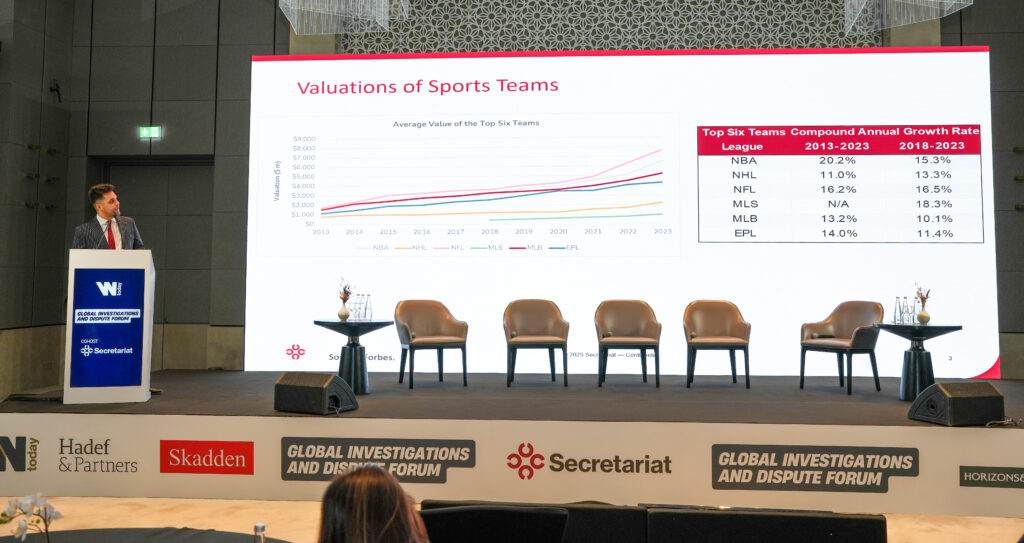

Sports teams are no longer “passionate investments,” but attractive assets with increasing returns.

Shalabh Gupta and Amran Nawaz presented “Valuations of Sports Teams on the Rise: A Tale of Two Continents.” They discussed how sports teams are increasingly viewed as assets for sophisticated investors, with valuations influenced by factors such as league structures, revenue distribution, financial regulations, and growing fan bases. The discussion explored recent marquee transactions, including the Washington Commanders and Boston Celtics, highlighting how investment from private equity and sovereign wealth funds is reshaping the investment landscape. The presentation also touched on trends in value drivers such as the growth of women’s sports, investment in multipurpose stadium infrastructure, and the rise of multi-team ownership.

In today’s increasingly complex valuation landscape, professional skills, thoughtful insights, and real-world experience matter more than ever.

Ivy Tse noted the impressive diversity of Chartered Business Valuators attending CBV CONNECT—ranging from business executives, legal professionals, and other industry leaders. This multidisciplinary mix not only enriched the dialogue but also created meaningful networking opportunities across sectors. We were thrilled to help shape this dialogue, with both Secretariat-led sessions garnering well-received feedback from attendees.

CBV CONNECT 2025 was a dynamic, knowledge-packed event, reflecting the exciting developments in the business valuation industry—from new tools and technologies to new approaches for navigating evolving global standards. Connect with us today to learn more about how these new and emerging developments could impact your organization.

56 Secretariat experts were recognized in the Lexology Index 2025 Construction report as leading experts, lauded for their elite expertise, leadership, and client service. 12 of our experts were named as Global Elite Thought Leaders in the report, earning us the No. 1 spot in that category out of more than 650 ranked firms.

Lexology’s report showcases top construction industry experts around the world, based on comprehensive research and nominations from corporate counsel and peers. The Global Elite Thought Leaders tier is the most exclusive in the Lexology rankings, achieved by only 5% of listed professionals.

“This distinction underscores the caliber and global impact of Secretariat’s experts as well as the deep trust our clients place in us,” says Managing Director Don Harvey. “Uncompromising quality has always been a hallmark of our work and our professionals. This further demonstrates the excellence and credibility our team brings to the most complex and high-stakes matters around the world.”

From top global voices to brilliant young professionals emerging as leaders in the field, Secretariat’s experts bring unmatched quality and our collective decades of experience to the table, offering clear, concise opinions and a proactive approach to help clients navigate high-stakes matters with confidence.

Discover what clients and peers have to say about our elite experts in Lexology’s full report.

Global Elite Thought Leaders

- Paul Roberts is regarded by clients as a “technically excellent expert” who is “robust and thorough in his approach.”

- A “very well-regarded and solid expert,” Christopher Larkin is known as an “exceptional force in the construction space.”

- Robert Poole is “very analytical,” incredibly responsive and diligent,” with references noting, “he delivers great work and is a fantastic witness.”

- Liam Holder is “a brilliant expert, a huge authority and very reliable.” Clients see him as a “top name in the construction market” who “testifies very well and is strong in the box.”

- George Taft, an “impressive and engaging expert,” is lauded by clients as being a “strong, hard-working experts who delivers great reports.” He is praised as being “very thorough and easy to work with.”

- Mike Allen “possesses in-depth knowledge and experience in the construction field.” Client say he applies his “great attention to detail” to “get to the crux of an issue and provide pragmatic and clear views.”

- With a “great reputation in the Singapore market,” Amit Garg is commended as being “competent and on top of the matter.”

- John Lancaster is “one of the top delay experts in the world,” valued for his “deep knowledge of delay analysis” and ability to “[perform] well under cross-examination.”

- A “top-drawer forensic delay expert,” Mike Saulsbury “[provides] clear, concise, and accurate assessments” that impress clients and industry peers, and is regarded as being “confident and commanding under cross-examination.”

- Don Harvey is lauded by clients for “his work in complex construction disputes, where he provides top-tier analysis on delay, disruption and cost issues.”

- Ted Scott is “committed to expanding the role of forensic experts early on in order to help resolve disputes.” Clients note his ability to “jump into complex matters with ease.”

- Meera Wagman is a “blend of tenacity, critical acuity and clear-sighted communications is particularly impressive.” Lexology quotes clients as saying Meera “excels in the fundamental technical skills necessary to her role while seeing the forest, not just the trees,” and that “she clearly communicates and drafts insights and analysis.”

Thought Leaders

- Terry Hawkins is “precise, technically excellent and client-focused.” He is applauded for his “real attention to detail” and expertise in staying “brilliantly calm when cross-examined.”

- With “absolute clarity in thought and the ability to stay on the ground with a steady but courteous demeanor,” Ben Burley is highly-regarded for his capacity to “foresee issues and advise on strategies to tackle them ahead of time.”

- Jeffrey Wong, a “highly organized, methodical and technically skilled” expert, is trusted to “consistently [provide] strong, logical evidence.” Sources note that Jeffrey’s “ability to analyze complex matters with clarity and precision makes him a valuable asset to any case.”

- Manus Bradley is praised in Lexology’s report as a “leading expert in the field” and an “outstanding delay expert.”

- Clients commend Ian Greenhough as “one of the best quantum experts in the region.” They view him as a “highly competent expert who presents solid evidence” and remains “authentic and assured under cross-examination.”

- Thomas Fertitta is a “strong schedule delay expert” who is “excellent in presenting claims and the basis for those claims to the tribunal.”

- A “pragmatic practitioner,” Neil Gaudion has earned high praise from clients, who note that Neil is an “exceptional testifying expert.”

- Mike Kling is described as “incredibly professional, diligent, and easy to work with,” with peers calling him an “outstanding expert.”

Recommended Professionals

- Jonathan Brown is an “extremely well organized” expert who offers “high-quality work product.” One client notes, “he produced several helpful ideas which were highly beneficial to our client’s matter.”

- “Quick to grasp the key issues and commercially minded,” Joel Glover is “very thorough, and produces high-quality analysis and written reports,” which clients praise as always being “well-reasoned, clear, and balanced.”

- Charmy Patel is a detailed, collaborative, “highly professional and savvy expert” who sources trust to provide “high quality expert analysis and service.”

- Georges Bader “has excellent analytical skills as well as oral and written advocacy.” He is regarded by clients as “extremely helpful and capable of quickly and efficiently reviewing documents” and producing clear, concise reports.

- Regarded as a “top-tier expert,” Oliver Barnes is praised for his ability to provide fast, timely, impactful analyses and his “[excellence] in cross-examinations.”

- Clients commend Mehmet Karakoc’s “ hugely impressive ability to assimilate enormous volumes of data and present it persuasively,” noting that he is “an excellent expert who does a lot of work in the construction field.”

- Sue Kim is a meticulous, diligent expert with “strong skills in quantum analysis” and “an outstanding reputation in the market and amongst clients.”

- Nicolas Noyer, a strategic expert who is known for being “detail-oriented and very pragmatic in his approach,” is commended for his leadership and his “great command of he details, knowing the documents inside and out.”

- Kaz Rozputynski’s “deep understanding of delay matters in construction projects” fosters great trust from clients, with sources saying “he is very responsive and detail-oriented,” and a “diligent expert with excellent work ethic.”

- Rhiann Storey possesses “excellent knowledge of the construction industry.” She is “thorough and able to handle a massive amount of data in a short period of time,” and is skilled in transforming that data into “clear and concise written work.”

- Sources find Alex Ho to be a “diligent and patient expert.” They appreciate his “eye for detail” and detailed yet easily-understandable reports and analyses.

- Matthew Wills “demonstrates a high level of competence by effectively untangling complex matters,” with clients lauding his prowess in presenting those issues “in a clear and understandable way.”

- Kagan Aktas is an “excellent,” “extremely diligent and technically informed delay expert,” with clients saying, “his presentation is courteous, clear, and comprehensive.”

- Chris Brindisi has garnered high praise from clients, with one stating, “Chris’s report writing stood out against everyone I’ve ever worked with.” He is regarded as a “very practical” expert and a “class act [whose] work product is always top quality.”

- Bryan Byrd is renowned for his “deep expertise in cost and schedule analysis and has vast experience advising on major domestic and cross-border construction projects.”

- Dan Clark offers clients a “strong ability to explain complicated concepts to a jury and “identify useful key points from a large amount of complicated information.”

- A “very smart expert,” Tom Gaines impresses clients with his “technical abilities and intellectual capacity.”

- A skilled and experienced expert, Wayne Kalayjian provides practical analyses and “first-rate presentation skills” to help clients navigate complex damages matters.

- Chris Sullivan’s clients rely on his “excellent client relationship skills” and “deep knowledge of the construction process,” stating that he is “very organized, focused and gets to the point” and “excellent at distilling delay events in simple terms.”

- A “fantastic construction expert,” sources laud Brian Triche for his impressive ability to “[back] up his findings with solid analysis.”

- Les Ross is “an industrious expert” who is consistently “across the details of a matter and provides answers to queries in a prompt manner.”

- Sena Gbedemah is a first-rate expert, praised by clients and peers for his “formidable technical prowess as a delay expert.”

- Mark Vaughan-Jones comes heralded as “someone who is exactly what you want from an expert.” One source adds, “his thorough and detailed approach is reassuring.”

- Brian Bowie is a “greatly appreciated delay expert” who is highly commended for his “technical skill and well-considered conclusions.”

- Nelson Gallardo stands out for being “very detailed, precise and methodical in the search and organzation of facts to analyse and prepare objective reports.”

Future Leaders

- Tom Hawkins is a strong communicator and detail-oriented expert who possesses an “excellent technical knowledge of quantity surveying and construction” and great ability to “[report] his findings accurately and reliably.”

- Tosh Masson is viewed as a “brilliant, young expert” who “consistently delivers excellent report writing, combining clear, precise language with thorough analytical insight.”

- An “exemplary expert witness in the field of quantum,” Gareth McDermott is praised by sources for “delving deeply into complex topics and providing comprehensive insights.” One client notes, “his preparation is thorough and meticulous, ensuring that every detail is carefully examined.”

- Michael Pogue “consistently demonstrates professionalism and a strategic approach in his expert work,” with sources describing him as “meticulous in analysis and thorough in execution.”

- Yasir Kadhim possesses “an impressive ability to absorb and distill large volumes of material quickly into draft reports and other key documents.” Clients trust him to “[think] proactively and [provide] strategic guidance on short notice.”

- Stuart Allan is regarded as “a pleasure to work with, and clients would gladly collaborate with him again.” One client is cited as saying, “Stuart’s strategy was simply brilliant and delivered within a very tight timeframe.”

- A “meticulous and precise practitioner” who is “well-known in the market,” Kelsey Bishop is applauded for her professionalism and her “outstanding knowledge” of the field.

- Madison Clark is a “dedicated, hardworking” expert who can identify the causes and consequences of the changes in a construction schedule,” and then use that information to communicate and resolve issues “with simplicity and clarity.”

- “Professional, confident, and concise in all his work,” Zackery Kilgore blends “deep [industry] knowledge” with “the rare ability to keep sight of the bigger picture without getting lost in detail.”

- Vivienne Li is “an excellent delay expert” with broad international experience handling complex transport disputes. Sources say, “She is efficient, responsive and highly intelligent.”

In an era of intensifying regulatory scrutiny, shifting geopolitical priorities, and rapid technological advancements, the GRC Today Forum 2025 delivered critical insights for investigations and compliance professionals navigating this evolving landscape. Hosted by The Wealth Today and ADGM in Abu Dhabi, the forum gathered leading industry experts to explore how institutions can enhance governance and develop proactive risk management strategies amidst an increasingly stringent financial environment.

As a proud sponsor of this year’s GRC Forum, Secretariat was honored to help shape this dialogue, sharing data-driven insights on jurisdictional vulnerabilities and strategic approaches to building resilient compliance frameworks.

Our experts’ contributions and panel discussions—particularly our presentation on the Global Financial and Economic Crime Outlook 2025 and the Secretariat Economic Crime Index (SECI)—were met with positive feedback and reinforced our role as a leading authority helping organizations navigate the interconnected challenges of global compliance and financial crime prevention.

Key Themes and Takeaways

1. Bridging the C-Suite and Compliance: A Strategic Imperative

The evolving relationship between compliance and C-suite professionals was a key discussion topic throughout the forum. In the panel “(Re)defining the Compliance and C-Suite Relationship,” moderated by Bhavin Shah, experts emphasized that compliance can no longer be a reactive obligation— it’s a strategic function that enables trust and informs critical decisions. When business leaders prioritize compliance strategies, they ensure regulatory alignment while driving long-term resilience.

2. Regulatory Frameworks Are Evolving—So Must Institutions

Regulatory frameworks are evolving to meet the demands of a more complex and interconnected financial landscape. Touching on international standards, financial crime, and operational resilience, the closing panel, “Regulatory Priorities and Enhancements to Regulatory Frameworks,” moderated by Ralph Stobwasser, emphasized that regulatory change is about smarter, more adaptive oversight. Institutions must embed foresight into their compliance strategies to stay aligned with shifting expectations and global enforcement priorities.

3. AI Integration in Risk and Compliance

AI was a recurring theme across multiple sessions, with real-world use cases demonstrating how organizations are integrating AI solutions into their business functions. From revolutionary RegTech technology to fraud detection and regulatory reporting, AI is reshaping compliance operations—but panelists emphasized the need for thoughtful integration, governed by transparency and ethics. As financial crime techniques evolve, institutions must leverage AI not only as a tool for detection but also as a strategic component of their broader risk management frameworks.

4. Developing Frameworks for Emerging FinTech, Crypto, and DeFi Technologies

The rise of digital finance presents opportunities and regulatory challenges. As FinTech and crypto ecosystems mature, institutions must build flexible, tech-enabled compliance frameworks that adapt to evolving licensing regimes, cross-border requirements, and digital asset scrutiny.

5. Modernizing AML Toward Integrated Financial Crime Prevention

Anti-money laundering (AML) efforts must evolve from siloed programs to integrated, enterprise-wide strategies. The forum highlighted the need for real-time data sharing, cross-functional collaboration, and unified risk views to combat increasingly sophisticated financial crime threats.

6. Data-Driven Risk Management

Tools like SECI and AI-powered analytics enable organizations to identify, respond to, and mitigate risk in real time. Organizations that understand and invest in these tools are better equipped to anticipate risk and demonstrate regulatory readiness in a rapidly evolving environment.

These themes built directly on the momentum of the Global Investigations and Disputes Forum (GIDF), which Secretariat proudly cohosted with The Wealth Today last month in Dubai. While the GIDF explored the investigative and enforcement side of global risk—focusing on cross-border investigations, AI and blockchain in dispute resolution, and corporate integrity—the GRC Forum extended that conversation into the operational heart of compliance. Together, the two events offered a comprehensive view of the risk lifecycle, from identification and investigation to prevention, governance, and long-term resilience.

At Secretariat, we’re proud to contribute to this global dialogue and help our clients navigate today’s complex regulatory landscape with confidence and clarity.

Secretariat Experts and Colleagues at the GRC Today Forum:

Philip Nelson provided expert analysis and testimony for defendant Capital Petroleum Group in the District of Columbia v. Capitol Petroleum Group, LLC et al. matter, which was filed in the Superior Court of the District of Columbia.

This case involved the wholesale and retail sale of gasoline in the District of Columbia (DC) during the District’s COVID-19 emergency. The Plaintiff (the District of Columbia) alleged that the Defendant (Capitol Petroleum) had violated both DC’s Natural Disaster Consumer Protection Act (NDCPA) and its Consumer Protection Procedures Act (CPPA) by engaging in illegal price gouging and unfairly increasing profits on gas distribution during the COVID pandemic.

Secretariat was retained by Bassman, Mitchell, Alfano & Leiter, Chartered on behalf of the Defendant. Dr. Nelson provided compelling economic analysis that led the Plaintiff to drop its CPPA claim (akin to an FTC ACT unfair competition claim) and settle the NDCPA claim (a price gouging claim). With respect to the CPPA claim, Dr. Nelson’s testimony evaluated whether the Plaintiff had provided sufficient economic analysis to prove that the Defendant had significant, unilateral market power or were engaging in anticompetitive conduct. With respect to the NDCPA claim, Dr. Nelson provided economic analysis that supported the empirical studies conducted by another industry expert, who showed that the Defendant actually lowered their retail gasoline prices and lost money at the time they were alleged to have undertaken price gouging.

The Secretariat team supporting Dr. Nelson on this case included Jessica Serody, Madison Ondo, Ndeye Njie, Pranick Chamlagai, and Shahid Shabab.

Tanner Weil and Marc Pichon will present their paper, “Leveraging Business Intelligence Platforms for Data Analytics in Forensic Schedule Analysis & Quantification of Damages for Construction Projects” at the Association for the Advancement of Cost Engineering (AACE) 2025 Conference & Expo, taking place June 15-17 in Anaheim, California. This session will explore how modern BI platforms are transforming the way analysts handle large construction datasets, enhancing efficiency and clarity in forensic schedule delay analyses and damages quantification for construction projects of all sizes (including mega projects).

We look forward to sharing our expertise and engaging with leading cost and project controls experts and dedicated professionals at this global forum, shaping meaningful conversations about how we can leverage emerging technologies to build a more collaborative, efficient, and transparent future for construction analytics.

This session will be held on Sunday, June 15 from 2:50 PM to 3:50 PM in Orange County Ballroom 3. To learn more and register for the conference, please visit the following link: 2025 Conference & Expo Registration.

Managing Director Steven Schwartz submitted expert reports and testimony arguing in favor of class certification on behalf of approximately 32,000 PC game publishers in antitrust litigation brought against Valve, the largest PC video game distributor in the world.

A US District Court for the Western District of Washington granted certification to a class of approximately 32,000 PC game developers (“Plaintiffs”) alleging antitrust violations against Valve Corporation (“Valve”), the operator of the Steam gaming platform. Dr. Schwartz was retained by four law firms representing the class (Quinn Emanuel, Wilson Sonsini Goodrich & Rosati, Constantine Cannon, and Lockridge Grindal Nauen) to assess the competitive impact and damages from the alleged anticompetitive behavior and to assess whether the issues in the case could be analyzed using evidence common across the class. During the class certification phase of the litigation, Dr. Schwartz submitted three expert reports and provided deposition testimony on behalf of Plaintiffs.

Judge Jamal N. Whitehead accepted Dr. Schwartz’s opinions and certified the proposed class, concluding that Plaintiffs presented a cogent market definition, met the predominance burden for antitrust injury, and demonstrated that damages can be measured across the class. Judge Whitehead also rejected all challenges to Dr. Schwartz’s testimony. “Dr. Schwartz’s methods are reliable and within the norms for admission,” the ruling states, while Valve’s arguments against his testimony, “go to the weight of the evidence, rather than admissibility.”[1]

Originally filed in 2021, Plaintiffs’ suit alleges that Valve violated Sections 1 and 2 of the Sherman Act and Washington’s Consumer Protection Act by implementing a Platform Most-Favored-Nations (PMFN) clause on publishers who sell their games on Steam. The clause allegedly requires content and price parity for any game distributed on Steam, meaning that game publishers must sell games at the same price on Steam as on other platforms and cannot have any different content from the content available on Steam. Moreover, Plaintiffs contend Valve may enact punitive measures against game publishers who violate the PMFN clause, removing games from its in-platform marketing efforts or delisting them from the Steam store altogether. Plaintiffs alleged that Valve’s PMFN clause results in anti-competitive impacts that inhibit competition and allow Valve to earn a supracompetitive commission on sales made through Steam, essentially enabling Valve to maintain a monopoly in the PC video game digital distribution market.

“Our team conducted robust economic analysis, provided objective evidence, and demonstrated the broader market impact of Valve’s alleged PMFN policy,” said Dr. Schwartz. “I am pleased that the Court granted class certification and look forward to presenting our analysis to the jury in this very important antitrust case.”

The Secretariat team supporting Dr. Schwartz during the class certification phase of the case included Stephanie Khoury, Matt Farber, Richard Brady, Nathan Mather, Anthony Papac, Neilson Nipper, Jacob Miller, Jack Schwartz, Grace Martens, Oliver Saffery, and Alex Smith.

Read the ruling in full here.

[1] Wolfire Games LLC et al v. Valve Corporation, No. 2:2021cv00563, accessed April 29, 2025, https://www.lit-antitrust.aoshearman.com/siteFiles/48231/[Antitrust]%20Court%20Order%20-%20certifying%20class.pdf

Nine Secretariat intellectual property experts have been recognized in the IAM Patent 1000: The World’s Leading Patent Professionals 2025 for their world-class patent litigation expertise.

The IAM Patent 1000 is a globally respected guide that identifies the top expert witnesses and professionals in the patent litigation field. IAM‘s research and selection process is rigorous, involving more than 1,800 interviews with industry specialists and clients around the world. Only those identified by market sources for their outstanding skillsets and profound insights into patent matters earn a place in the listings.

Our industry-leading professionals have been consistently recognized as experts by IAM for over a decade. They offer exceptional knowledge of the economics of intellectual property and technology across a spectrum of life sciences, electronics, and other industries.

Here’s what IAM and our global clients had to say about our recognized experts:

- Appearing in his third consecutive IAM listing, Bruce Blacker is a seasoned expert witness who “offers expert consulting on business and accounting matters for both large corporations and nonprofit organizations.”

- Richard Brady, in his sixth IAM recognition, is an expert in microeconomics and financial analysis, lauded for his ability to “tackle even the most complex matters with confidence, including the recent successful examination of the domestic industry under the economic prong for Sartorius at the ITC.”

- Carrie Distler is commended by IAM and clients alike, who note how she “amplifies the team’s talent with her extensive experience in valuation and testifying, offering specialist insights into complex royalty assessments and cost analysis.”

- Richard Manning, who appears for the third year in a row, “helps clients tackle their most challenging economic issues.” The listing highlighted that Richard “has worked on numerous matters for Regeneron, including both defence and plaintiff-side commercial success reports and depositions. [His] testimony proved that commercial success can be a foundation for a non-obviousness argument and the importance of patents to commercial success.”

- Nisha Mody, recognized for the fourth consecutive year, is showcased as “a trusted consultant for top US law firms.” IAM notes that Nisha has “provided trial testimony and depositions in nearly 100 cases.”

- Aminta Raffalovich is again recognized for her technology expertise who “offers expert deposition and trial testimony in infringement disputes.” IAM highlights that Aminta is “a prime choice for disputes in tech-heavy areas, analyzing patent damages, and evaluating commercial success with finesse.”

- In his sixth IAM listing, Steve Schwartz is commended as trusted expert who “provides exceptional analysis for his patrons in both litigation and non-litigation contexts.” IAM notes, “in a current case, he was retained for analysis over antitrust counterclaims in a patent infringement matter for Masimo against Apple.”

- Ryan Sullivan is recognized for an incredible twelfth consecutive year. The listing showcases Ryan’s “three-decades plus of experience,” adding that he “is no stranger to high-stakes litigation and trade secrets testimony.” Ryan is also applauded for his work with Aminta on a recent engagement in which Secretariat offered expert deposition and trial testimony over a permanent injunction followed by a $19 million infringement verdict against Invitae.

- In her second consecutive IAM listing, Jennifer Vanderhart is recognized for her ability to “extend [her] knowledge to investigate expropriation claims by foreign governments and, domestically, focus on assessing economic damages in patent and other IP disputes.”

In their firm profile of Secretariat, IAM also writes, “dedicated to the core values of innovation and kindness, Secretariat stocks a team of well-versed economic consultants across its US offices.”

We’re thrilled to celebrate this recognition, applaud the achievements and hard work of our experts, and celebrate our firm’s culture of excellence, professional growth, and top-tier client service.

The full announcement and IAM Patent 1000 listing can be accessed here.

Secretariat is delighted to congratulate our recently promoted Managing Directors: Deven Bowles, Erica Greulich, Greg Johnson, Zack Kilgore, Gareth McDermott, Tony Nedinsky, Michael Pogue, and Ivy Tse.

Each of our new MDs has demonstrated that they represent the best of Secretariat—consistently delivering the highest-quality work, earning the trust of our clients through exceptional judgment and integrity, and exemplifying the values that define who we are.

“Developing talent from within and providing opportunities for our high performers to own and advance their careers are hallmarks of what make our firm unique,” says Managing Director Don Harvey. “This commitment not only strengthens our culture but also ensures we continue to grow in a smart, strategic way.”

We are thrilled to congratulate our newest MDs on this well-earned achievement and celebrate the impact they will continue to have in the years ahead.

Deven Bowles

Damages & Valuations | Houston

Deven has nearly 20 years of experience in both industry and consulting roles within the energy sector. He provides expert testimony and other dispute advisory services to law firms and their clients, having testified in U.S. State and Federal courts on more than 100 occasions. He has extensive, hands-on experience in multiple areas of oil and gas production, including upstream and midstream sectors. His testimony and consulting experience frequently deal with contractual disputes and industry customs and practices, including royalty valuation, market value analysis, production in paying quantities, infrastructure and rate disputes, damages quantification, product imbalances, and other commercial issues.

Erica Greulich, PhD

Antitrust & Competition | San Francisco

Erica specializes in empirical microeconomics and quantitative analysis. Her consulting engagements frequently concern antitrust, employment, discrimination, and breach of contract matters. She has consulted on numerous class action engagements and testified regarding labor market conditions and lost earnings. Erica’s research and experience have focused on the nexus between regulation, housing markets, and wage and employment outcomes. Her research has been published in the Brookings-Wharton Papers on Urban Affairs and Regional Science and Urban Economics.

Greg Johnson

Damages & Valuations | Washington, DC

Greg focuses on financial and economic issues in complex international disputes. He has worked on projects spanning a wide range of industries, including renewable energy, oil and gas, power, telecommunications, mining, manufacturing, and banking. His experience is global, with past cases in North America, South America, Europe, Central Asia, and the Middle East. He has served as a valuation/damages expert in ICSID and ICC disputes. Clients have remarked on Greg’s strong attention to detail, focused involvement in every project, and ability to convey complex quantum issues in an easy-to-understand manner.

Zack Kilgore

Construction Delay | Atlanta

Zack has more than 15 years of experience in the construction industry, specializing in dispute resolution, delay analysis, scheduling, claims, project controls, and construction and project management. He has provided expert services to owners and contractors across a wide range of projects worldwide. His work includes airports, petrochemical plants, light-rail projects, refineries, water treatment plants, government buildings, salvage operations, highways, and commercial mixed-use facilities. Earlier in his career, Zack was a field engineer and construction manager working internationally on several multi-billion-dollar projects.

Gareth McDermott

Construction Quantum | London

Gareth has nearly 20 years of experience working on major international construction, engineering, and energy projects, specializing in dispute resolution and forensic investigation of quantum claims. He has worked on projects of varying size and complexity in numerous sectors, including buildings, civil engineering, infrastructure, off-shore oil & gas facilities, marine, and process works. He has been appointed quantum expert in litigation, adjudication, and mediation proceedings. Gareth regularly provides advice and opinion on matters concerning variations, defective works, delay, acceleration, disruption, termination, costs to complete, and final accounts.

Tony Nedinsky

Construction Delay | Washington, DC

Tony’s professional experience includes advising owners, contractors, and stakeholders on matters that include project controls, scheduling/programming, contract disputes, and claims. He has been appointed as an independent expert on scheduling/programming and project delay on construction disputes in arbitration, litigation, and mediation. Tony’s extensive expertise in critical path method (CPM) scheduling/programming makes him a trusted expert for project delay claims and disputes, including analyses related to delay, disruption, productivity, time impacts, acceleration, and other project management and construction issues.

Michael Pogue

Construction Quantum | London

Michael is a chartered quantity surveyor specializing in providing quantum expert opinions on construction and engineering-related disputes. He is skilled at applying quantity surveying principles to the valuation of high-value claims, often with complex factual matrices such as disruption, escalation of costs, defective works, and the re-procurement and completion of works following termination. He draws on over 15 years of experience from major construction and engineering projects in most global regions and across multiple industry sectors, including energy, aviation, rail, highways, and utilities.

Ivy Tse

Damages & Valuations | Toronto

Ivy has more than 15 years of experience in business valuation, damages quantification, financial advisory, forensic investigations, and commercial litigation and disputes. She has worked with privately-owned and publicly-traded companies on a variety of matters, including breach of contract disputes, post-transaction disputes, business interruption claims, breach of fiduciary duties, and suspected corporate and employee wrongdoing. This includes the preparation of numerous damages quantification analyses and expert reports for a wide range of loss claims, including those in the multi-billion-dollar range. Additionally, Ivy has performed extensive forensic accounting investigations for companies with complex organizational structures.

Managing Director Bob Broxson provided expert reports, deposition, and trial testimony on behalf of Marathon Oil Co. in a high-stakes, precedent-setting contract dispute arising from a natural gas delivery impeded in 2021 by Winter Storm Uri.

A Texas federal jury rejected a $123.7 million breach-of-contract counterclaim filed by Koch Energy Services LLC, ruling in favor of Marathon’s force majeure defense related to natural gas deliveries during the historic storm. Marathon also prevailed on a partial summary judgment, with the jury requiring Koch to pay $9.8 million on Marathon’s breach of contract claim.

Mr. Broxson was retained by Ahmad Zavitsanos & Mensing to provide expert testimony challenging the claims made by Koch. Mr. Broxson provided direct testimony and was cross-examined on issues related to the common practices within the natural gas industry related to claims of force majeure in a six-day trial in Houston’s U.S. District Court for the Southern District of Texas.

The Secretariat team supporting Mr. Broxson on this matter included Adam Housel, Kaarle Rautio, and Tyler Anderson.

Law360 coverage of the matter is available here (subscription may be required).

On May 7, Secretariat and The Wealth Today jointly hosted the Global Investigations and Disputes Forum (GIDF) in Dubai, attracting more than 300 attendees and 30 speakers from around the world. This dynamic forum unpacked key challenges in corporate investigations, crisis management, dispute resolution, and regulatory compliance, offering strategies for risk mitigation and corporate liability. Participants had the unique opportunity to network with top investigations professionals, attend insightful and interactive panel discussions, and hear from industry leaders on crucial financial crime topics, including cross-border investigations, AI and blockchain in dispute resolution, and corporate integrity.

In a headlining session, Bhavin Shah and Ralph Stobwasser explored “The Global Financial and Economic Crime Outlook: Trends and Predictions.” They discussed Secretariat’s Global Financial and Economic Crime Risk Outlook 2025, sharing insights on emerging trends and strategic responses to combat global financial crime.

The session equipped attendees with essential tools for navigating the evolving global sanctions landscape, best practices for export controls and compliance, and key insights about the advanced technologies reshaping today’s risk landscape. Bhavin and Ralph’s discussion emphasized the importance of proactive measures and strategic planning to mitigate risk and reinforce resilience amidst the increasingly sophisticated financial crime arena.

Later in the morning, May Mhanna moderated a panel on “Family Disputes, UHNI & Financial Litigation Strategies.” The panel featured valuable conversations about managing complex disputes, discussing key issues such as control dynamics, personality dynamics, trust structure & execution, dispute resolution, and the delicate balance between transparency and secrecy in high-stakes litigation. Panelists discussed FCPA and global anti-bribery regulations, the intersection of sanctions, AML, and CFT frameworks, and explored financial crimes through the lens of enforcement case studies. This panel featured engaging conversations with Mohamed El Ghatit (OGH Legal), Marcus Parker (Stewarts), Ali Al Zarouni (Horizons & Co Law Firm), and Naief Yahia (Al Tamimi & Co).

In their panel discussion, “Role of Experts in Arbitration & Litigation: Bridging the Gap,” Chaitanya Arora (serving as moderator) and Ian Greenhough engaged in a dynamic discussion on how the early introduction of a seasoned independent expert witness adds clarity and credibility to complex disputes. Joined by panelists Walid Azzam (Hadef & Partners). Zeeshan Dhar (Yung Technology (FO of HRH Prince Faisal Bin Abdullah Al Saud)), Kunal Vajani (Fox and Mandal), and Shane Jury (Ashurst), our experts covered legal and financial complexities in UHNI family disputes, best practices for dispute resolution in high-stakes family matters, and strategies for financial litigation and navigating criminal litigation disputes.

Stephen Millington expertly moderated the panel on “Financial Statement Fraud, Short Sellers & Market Impact,” where panelists shared perspectives on market manipulation, investor protection, and regulatory response. This important dialogue at the intersection of finance, law, and accountability included discussions of financial statement fraud case studies, the role of short sellers, the impact of market news and cross-market listings, and how financial crimes influence market stability. Panelists for this session were Steve Smith (Eversheds Sutherland), Collin Lobo (HSBC), and Yaser Moustafa (Janus Henderson Investors).

The panel on “Reputation Management, Business Intelligence & Dispute Financing,” moderated by Charlie Warren, delivered sharp insights on protecting brand value, leveraging intelligence to anticipate risk, aligning legal and communication strategies in high-stakes matters, and financing strategies for complex disputes. Panelists Bryan Stirewalt (Grant Thornton UAE), Nicholas McDonagh (Teneo), and Benjamin S. Haley (Covington & Burling) explored how to protect your brand during high-stakes investigations and disputes, and how to navigate the evolving landscape of reputation management and business intelligence.

Later, Amran Nawaz spoke on “Sports: M&A, Investments, and Disputes,” demonstrating expertise in managing high-profile sports transactions and disputes, sharing vital knowledge, and highlighting the evolving relationship between law, business, and sports.

In the closing session, Ralph Stobwasser moderated “The Complexity Of Tracing and Ultimately Recovering Digital Assets,” alongside panelists Kanika Sharma (Fulcrum Capital), Abhinav Sharma (Dentons Link Legal), Joe Durkin (Burford Capital), and Priyank Ladoia (AZB & Partners). The panel covered legal, financial, and forensic strategies, along with key policy developments in India and the UAE. Panelists addressed developments in tracing assets in terms of technology, techniques, and transparency, navigating cross-jurisdictional barriers, practical considerations when freezing assets in a volatile environment, and exploring the future of NPA and litigation funding.

We were proud to host the GIDF alongside The Wealth Today. This thought-provoking, engaging event was a testament to the power of knowledge-sharing and collaboration in addressing the emerging and urgent topics facing our industry. Connect with our experts to explore how our insights and strategies can benefit your organization.

Secretariat Experts, Colleagues, and Clients at the GIDF:

Secretariat team members Stuart Gurrea, Jéssica Dutra, Wei Tan, Pablo Varas, and Noah Case have contributed to “Chapter I — Restraints of Trade” in the recently published “2024 Annual Review of Antitrust Law Developments” from the ABA Antitrust Law Section. Michael Koenig contributed to “Chapter VIII — Civil Government Enforcement”.

For over 40 years, the publication and its annual supplements have been recognized as the most authoritative and comprehensive research tools for antitrust practitioners. This edition summarizes developments during 2024 in the courts, at the agencies, and in Congress.